Anticipating Income

|

This section includes the budgeting process of using data like the rate of pay and normal hours to create the budget because the income recently received is not expected to continue.

Policy

When the income received during an Income Request Period(g) does not accurately reflect a participant's expected income, FAA budgets income by anticipating income based on the verified changes. FAA creates a budget using information verified for the budget month(g) affected by a change. FAA budgets income for future months based on the change.

FAA anticipates income when a full month of income(g) is not received and the paychecks in an income request period do not reflect the income reasonably expected to continue, including any of the following situations:

●Decrease in pay rate

●Decrease in work hours

●Increase in pay rate

●Increase in work hours

●New source of income

●Terminated income

●Unusually high or low semi-monthly income

FAA needs verification from the income source to anticipate income. FAA discusses all the following required information with the participant:

●What is the reason recently received income is not expected to continue?

●How often are pay dates expected?

●Is there a regular pay frequency?

●What is the reasonably anticipated number of work hours in a pay period?

●What is the reasonably anticipated pay rate?

●Are there any other types of income expected, including and not limited to any of the following:

Bonuses

Incentives

Tips

FAA requests, reviews, and verifies a participant’s income received in a 30-day income period. The 30-day income period is often called an income request period. Even when the income is anticipated to change, some information from the 30-day income period or longer may be needed to check for patterns of what is normal for the participant.

NOTE FAA requests more than 30 calendar days of income when the application and interview dates are in different months.

During the application process, a budgetary unit is required to report changes in income after the application date and before the interview date for any of the following:

●New applications

●Renewal applications

After approval, the budgetary unit is required to report changes. See Participant Initiated Changes for more information about participant reporting requirements.

When a participant reports and verifies a change, FAA budgets anticipated future income. Due to changes in income, benefits levels often increase or decrease, or the budgetary unit can become ineligible for benefits.

See Notifying Participants of Actions Regarding Their Benefits for FAA time frame requirements when increasing, decreasing, or stopping benefits.

Procedures

When the participant is present, have them sign the Authority to Release Information (FAA‑1765A) form to contact any companies or businesses involved. The FAA-1765A can be faxed or emailed to the participant's employer when it is not possible to use the Application for Benefits (FAA-0001A) or the HEAplus Authority to Release signed statement.

When determining a budget using anticipated income, see one or more of the following for each budgeting month based on a discussion with the participant and the verified income:

Verification

System interface and the case file(g) must be reviewed before verification is requested. No additional verification is needed when AZTECS interface or HEAplus hubs have verified the information.

The participant has the primary responsibility for providing verification. (See Participant Responsibilities – Providing Verification for additional policy.)

For NA, all of the following income is required to be verified before eligibility is determined:

●Reported on a new application, during the interview of a new application, or changes reported before the eligibility determination of a new application.

●Changes after an eligibility determination of a new application (e.g., a renewal application, mid approval contact, etc.) and any of the following apply:

The source of the income has changed.

The income is questionable(g) or unclear(g).

The reported income amount has changed by $51 or more.

The previous verification in the case file is more than 59 calendar days old.

For CA, all income is required to be verified before determining eligibility.

See the specific income types for examples of verification that can be used.

Verification for a Break in Employment

All of the following verification is needed when a participant experiences a break in employment(g):

●The month the break of employment began.

●Reasonably anticipated ongoing income for the months after the break in employment ends.

●The last date the participant worked before the break in employment.

●The date the participant received their last paycheck.

●The date the participant returns to work.

●The date of the first paycheck is received after returning to work.

Verification of New Source of Income

All of the following information needs to be verified when the participant reports a new source of income:

●Name, address, and phone number of the source

●Date the first paycheck is received or expected to receive the income

●Pay frequency of income

●Day of the week paid, and dates income is received and scheduled to be received

●Pay period end dates

●Gross amount of income received, and amounts expected to be received

●Hourly wage

●Hours worked and expected to be worked

●Extra income, such as bonuses, tips, overtime

The Verification of New/Current Employment (FAA-0053A) is a form that an employer can complete to verify income. The FAA-0053A can be found on the DES Website in the Documents Center.

For information regarding verification of terminated income, see Budgeting Terminated Income.

AZTECS Keying Procedures

See one or more of the following for each budgeting month:

Examples

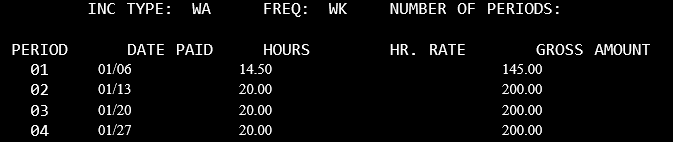

1) The participant applies and is interviewed on 01/20.

Income verification is received.

Verification includes a statement that income will increase to $200 weekly beginning 01/13. Key the following:

●For January, budget the actual known income received before the 01/20 interview and the expected income for the remainder of the month. Project income based on the verification provided. Key the following information on EAIC:

●For February and ongoing months, project the income change at $200 per week because it is expected and verified as ongoing. Key the following on EAIC.

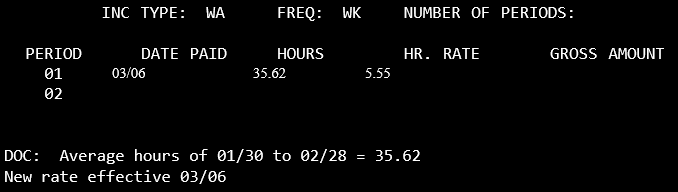

2) On 03/01, Angela reports an increase in the rate of pay effective for her 03/06 check. Angela provides the following verification of income and a participant’s statement that her hours will continue to vary:

|

Date Paid

|

Hours

|

|

01/30

|

38.4

|

|

02/06

|

33.6

|

|

02/13

|

35.0

|

|

02/20

|

37.1

|

|

02/27

|

34.0

|

Manually average the hours in the income period.

|

178.1

|

Total of hours

|

|

÷ 5

|

Divided by the number of periods

|

|

35.62

|

Average of hours

|

For April, key the following on EAIC:

NOTE Leave the GROSS AMOUNT field blank.

Legal Authorities

7 CFR 273.10(c)(1)

7 U.S.C. 2014 (f)(1)(A)

last revised 07/29/2024