Procedure: Anticipating Hourly and Pay Rate Changes

|

This section provides information about procedures for budgeting hours and pay rate changes.

Procedures

When the participant is present, have them sign the Authority to Release (FAA‑1765A) form to contact any companies or businesses involved. The FAA-1765A can be faxed or emailed to the participant's employer when it is not possible to use the Application for Benefits (FAA-0001A) or the HEAplus Authority to Release signed statement.

When working on a reported income change that causes a decrease in benefits or causes the benefits to stop, see Notice of Adverse Action to ensure the decrease or closure actions are taken for the correct budget month.

When a change report for income is received during the approval period, and the change causes a benefit decrease, see Effecting Changes.

Change in Work Hours

When the participant’s income changes due to an increase or decrease in the number of work hours and the pay rate does not change, budget income using the verified changes for the budget month and complete all of the following:

●In a budget month that the change occurred, complete all of the following:

Budget the paychecks already received in the budget month.

Budget the anticipated paychecks that are going to be received in the budget month at the new hours.

Convert the anticipated full month of income(g).

●For ongoing months, remove any paychecks at the old work hours. Anticipate income by using the paychecks based on the new hours.

(See Example 1 Anticipating Change in Hours)

Change in Pay Rate

For changes in pay rate, the work hours may or may not fluctuate. Budget income using the verified changes for ongoing months by completing one of the following:

●For a change in the rate of pay and the number of work hours does not fluctuate, complete all of the following:

1) Verify the change in rate of pay.

2) When a change occurs in a budget month, budget the income already received and any income verified as anticipated to be received at the new pay rate in the remainder of the month.

3) Convert a full month of income based on the frequency of pay.

4) In the following month, remove any paychecks at the old pay rate.

5) Use only the anticipated income at the new pay rate for ongoing months.

NOTE When a change happens, determine whether to budget income for the month the change occurred or for the month following the change.

●When there is a change in the rate of pay and the number of work hours fluctuates, to anticipate income, complete all of the following:

1) Verify the change in rate of pay and the hours the participant works.

2) Determine an average number of work hours reasonably expected during a pay period. Drop the third number after the decimal point.

3) For the budget month, include all verified gross amounts for the pay dates already received and any anticipated pay checks at the new pay rate.

4) Convert a full month of income based on the frequency of pay.

5) For ongoing months, remove pay checks at the old pay rate.

6) Anticipate ongoing months using only the anticipated pay checks with the new pay rate and averaged hours.

(See Example 2 Change in Rate of Pay)

Change in Pay Rate and Work Hours

For a change in pay rate and a change in the number of hours a participant works, complete all of the following:

●Verify the change with the source of the income.

●Use the appropriate frequency code.

●When hours fluctuate within a verified range, average the hours using the lowest and highest number of expected hours.

●Drop the third number after the decimal point.

●For the budget month, use the paychecks already received and any anticipated paychecks at the new pay rate and hours.

●Remove the paychecks at the old pay rate and work hours for ongoing months.

●For ongoing months, anticipate income by only budgeting paychecks at the new pay rate and work hours.

When a change report is for a new source of income during the approval period, and the change causes a benefit decrease, see Effecting Changes.

AZTECS Keying Procedures

Hours and Pay Rate Changes

When budgeting an income change that causes a decrease in benefits or causes the benefits to stop, see Notice of Adverse Action.

Change in Work Hours

When the budget month is the first month, work hours change complete all of the following:

1) Include all the paychecks already received in the budget month, and key all of the following:

As needed, the Income Type Code in the INC TYPE and the SUB TYP field.

The Income Frequency Code in the FREQ field.

The work hours in the HOURS field

Each of the pay dates in the DATE PAID field.

The gross income for each pay date in the GROSS AMOUNT field.

2) Anticipate any paychecks at the new work hours for the remaining pay dates in the budget month, key all of the following:

The Income Type Code in the INC TYPE and the SUB TYP field as needed.

The Income Frequency Code in the FREQ field.

Each of the pay dates in the DATE PAID field.

The new work hours in the HOURS field.

The rate of pay in HR. RATE field.

Leave the GROSS AMOUNT field blank. When all the income is entered, press ENTER, and AZTECS calculates and populates the GROSS AMOUNT field.

3) Ensure the case is in the current system month, and delete from EAIC all the paychecks with the old hours.

NOTE Double-check that only anticipated paychecks are budgeted using the new hours for ongoing months.

Changes in Pay Rate

When the budget month is the first month that the pay rate changes, complete all of the following:

1) Include all the paychecks already received in the budget month, and key all of the following:

The Income Type Code in the INC TYPE and the SUB TYP field as needed.

The Income Frequency Code in the FREQ field.

The work hours in the HOURS field.

Each of the pay dates in the DATE PAID field.

The gross income for each pay date in the GROSS AMOUNT field.

2) Anticipate any paychecks at the new rate of pay for the remaining pay dates in the budget month, key all of the following:

The Income Type Code in the INC TYPE and the SUB TYP field as needed.

The Income Frequency Code in the FREQ field.

Each of the pay dates in the DATE PAID field.

The hours in the HOURS field.

The new rate of pay in HR. RATE field.

Leave the GROSS AMOUNT field blank. When all the income is entered, press ENTER, and AZTECS calculates and populates the GROSS AMOUNT field.

3) Ensure the case is in the current system month, and delete from EAIC all the paychecks with the old pay rate.

NOTE Double-check that only anticipated income is budgeted using the new hours for ongoing months.

Changes in Pay Rate and Hours

When the budget month is the first month that the pay rate and hours change, complete all of the following:

1) Include all the paychecks already received in the budget month, and key all of the following:

The Income Type Code in the INC TYPE and the SUB TYP field as needed.

The Income Frequency Code in the FREQ field.

The work hours in the HOURS field

Each of the pay dates in the DATE PAID field.

The gross income for each pay date in the GROSS AMOUNT field.

2) Anticipate any paychecks at the new rate of pay and work hours for the remaining pay dates in the budget month, and key all of the following:

The Income Type Code in the INC TYPE and the SUB TYP field as needed.

The Income Frequency Code in the FREQ field.

Each of the pay dates in the DATE PAID field.

The hours in the HOURS field

The new rate of pay in HR. RATE field

Leave the GROSS AMOUNT field blank. When all the income is entered, press ENTER, and AZTECS calculates and populates the GROSS AMOUNT field.

3) Ensure the case is in the current system month(g), and delete from EAIC all the paychecks with the old pay rate and hours.

NOTE Double-check that only anticipated income is budgeted using the new hours for ongoing months.

Examples

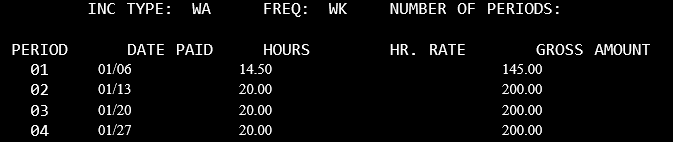

1) The participant applies and is interviewed on 01/20.

Income verification is received.

Verification includes a statement that hours will increase from 14.5 hours per week to 20 hours per week at the current rate of $10.00 per hour beginning with the pay date of 01/13. Key the following:

●For January, budget the actual known income received before the 01/20 interview and the expected income for the remainder of the month. Project income based on the verification provided. Key the following information on EAIC:

●For February and ongoing months, project the change in hours at 20 per week because it is expected and verified as ongoing. Key the following on EAIC.

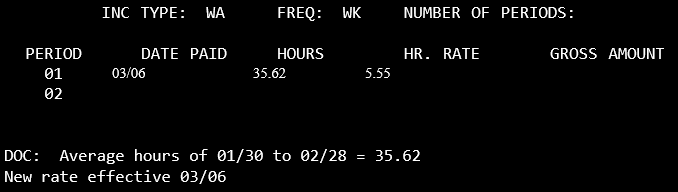

2) On 03/01, Angela reports an increase in the rate of pay effective for her 03/06 check. Angela provides all of the following verification of income and a participant’s statement that her hours will continue to vary:

|

Date Paid

|

Hours

|

|

01/30

|

38.4

|

|

02/06

|

33.6

|

|

02/13

|

35.0

|

|

02/20

|

37.1

|

|

02/27

|

34.0

|

Manually average the hours in the income period.

|

178.1

|

Total of hours

|

|

/ 5

|

Divided by the number of periods

|

|

35.62

|

Average of hours

|

For April, key the following on EAIC:

NOTE Leave the GROSS AMOUNT field blank.

last revised 04/15/2024