Procedure: Anticipating Semi-Monthly Income

|

This section provides information about procedures for budgeting semi-monthly income when projecting income is not an option.

Procedures

Income received or expected to be received twice a month is considered semi-monthly.

Semi-monthly and bi-weekly income are not the same and have different conversion factors. Semi-monthly pay dates are generally the same dates of the month. However, bi-weekly pay dates are generally the same day of the week (every other Friday, every other Monday, etc.). (See Example 1.)

When the participant identifies that both of the last two consecutive semi-monthly paychecks in the budgeting income period are normal, project the semi-monthly income by using both checks in the budget. (See Projecting a 30-day Income Period for budgeting instructions.) (See Example 2)

Semi-monthly income must be manually calculated when one or more of the following applies:

●At the start of a new source of income.

●There is an anticipated change.

●One or more paychecks in the 30-day income period do not represent the participant’s ongoing income.

To manually calculate semi-monthly income when average weekly hours are known complete all of the following:

●Determine the average work hours per week.

●Multiply the average work hours per week by the hourly pay rate. This amount is the anticipated weekly gross income.

●Multiply the anticipated weekly gross income by 4.3. This amount is the anticipated monthly income.

●Divide the anticipated monthly income by two. (Drop the third number after the decimal point, when needed.) This amount is the anticipated semi-monthly gross income for one semi-monthly pay period.

When any of the semi-monthly checks are not normal, do not use any of the checks unless it is received in the budget month. For ongoing months only use the anticipated semi-monthly gross amount. (See Example 3)

When the participant is present, have them sign the Authority to Release Information (FAA‑1765A) form to contact any companies or businesses involved. The FAA-1765A form can be faxed or emailed to the participant's employer when it is not possible to use the Application for Benefits (FAA-0001A) or the HEAplus Authority to Release signed statement.

AZTECS Keying Procedures

For semi-monthly income, key the SM Frequency Code unless the situation requires the use of the AC Frequency Code. (See AZTECS Frequency Codes for AC Frequency Code use situations.)

Document the case file(g) thoroughly to support keyed codes, amounts, and frequencies. See the AZTECS Data Entry Guide for instructions on keying the AZTECS income screens.

NOTE Documentation must support determinations of eligibility and benefit level. Document in sufficient detail to ensure that any reviewer can assess whether the determination is reasonable and accurate. Include specific information regarding the reason the income is determined to be normal. (See Budgeting Income Documentation Requirements for additional information.)

New Source of Income

For each budget month, complete all of the following:

●Key one of the following Frequency Codes in the FREQ field:

The AC Frequency Code when the participant receives less than a full month of income in the first month.

The SM Frequency Code when the participant receives a full month of income in the first month and ongoing months.

NOTE When one or more of the first checks are lower than normal because the participant started mid-week or due to training, do not consider this to be a full month of income.

●For each pay date received in the budget month, key all of the following:

The pay date in the DATE PAID field.

The hours worked in the HOURS field, when applicable.

The gross income received in the GROSS AMOUNT field.

NOTE Keep the HR. RATE field blank. AZTECS calculates the HR. RATE field. When the calculated HR. RATE field does not calculate close to what is on the pay stub, stop and investigate.

●When one or more pay checks in the budget month are unknown, key all of the following for each pay date:

The pay date in the DATE PAID field.

The anticipated hours per pay period in the HOURS field.

The rate of pay in the HR. RATE field.

NOTE When only average weekly hours are available, manually calculate the semi-monthly income as explained in the procedures and key all of the following for each pay date:

●The rate of pay in the HR. RATE field, when applicable.

●The anticipated semi-monthly gross income in the GROSS AMOUNT field.

After copying details to ongoing months, delete paychecks not received in the budget month.

High or Low Paychecks

When one or more paychecks in the 30-day income period do not represent the participant’s ongoing income, the paychecks are not used unless they were received in the budget month.

For each budget month, complete all of the following:

●Key the SM Frequency Code in the FREQ field.

●For each pay date received in the budget month, key all of the following:

The pay date in the DATE PAID field.

The hours worked in the HOURS field, when applicable.

The gross income received in the GROSS AMOUNT field.

NOTE Keep the HR. RATE field blank. AZTECS calculates the HR. RATE field. When the calculated HR. RATE field does not calculate close to what is on the pay stub, stop and investigate.

●For each remaining pay date in the budget month, key all of the following:

The pay date in the DATE PAID field.

The anticipated hours per pay period in the HOURS field.

The rate of pay in the HR. RATE field.

NOTE When only average weekly hours are available, manually calculate the semi-monthly income as explained in the procedures and key all of the following for each pay date:

●The rate of pay in the HR. RATE field, when applicable.

●The anticipated semi-monthly gross income in the GROSS AMOUNT field.

The budget month only contains anticipated income unless the paycheck was received in that budget month. After copying details to ongoing months, delete paychecks not received in the budget month when high or low semi-monthly pay is received. (See Example 3)

Normal and Ongoing

When the participant identifies that both of the last two consecutive semi-monthly paychecks in the budgeting income period are normal, see Projecting a 30-day Income Period for AZTECS Keying Procedures and Example 2.)

Examples

1) Jane gets paid bi-weekly because she gets paid every two weeks on Friday. Jim gets paid bi-weekly because he gets paid every other Monday. Sam gets paid semi-monthly because he gets paid on the 1st of the month and the 15th of the month. Jenny gets paid semi-monthly because she gets paid on the first workday of the month and the fifteenth workday of the month.

2) Arta applied for benefits on May 15th. Her employment is ongoing, and she is paid semi-monthly on the 15th and 30th of each month.

Arta was interviewed on May 18th, provided the following pay stubs, and stated that the pay is normal and expected to continue:

|

Date Paid

|

Hours

|

Gross Amount

|

|

04/30

|

82

|

$533

|

|

05/15

|

82

|

$533

|

Key the following on EAIC:

Press ENTER. AZTECS averages and converts to a monthly amount.

Arta's projected income for May and ongoing is $1066.

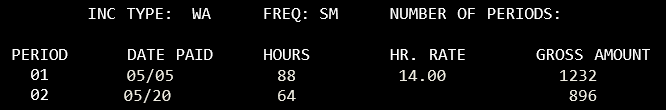

3) Harry applies for NA on 05/25 and provides the following paychecks during his interview on 06/06. He is paid twice per month on the 5th and the 20th of the month (semi-monthly).

|

Date Paid

|

Hours

|

Gross Amount

|

|

05/05

|

88

|

$1232

|

|

05/20

|

64

|

$896

|

|

06/05

|

96

|

$1344

|

Harry clarified that he normally works 5 days per week and 8 hours per day. His rate of pay is $14 per hour. However, the 05/20 paychecks is low because he does not have vacation time yet and had three days without pay due to his father’s funeral.

For the application month of May, the 05/05 and 05/20 paychecks must be used because they occurred in the budget month. However, because the 05/20 paycheck was lower than normal, the ongoing semi-monthly paycheck for 06/20 must be manually calculated.

To manually calculate the semi-monthly paycheck, complete all of the following:

●Determine the average hours per week. (8 hours times 5 days equals 40 average weekly hours)

●Multiply the average weekly hours by the hourly rate of pay to determine the average weekly pay. (40 hours times $14 equals $560 per week)

●Multiply the average weekly pay by 4.3 to determine the monthly pay. ($560 times 4.3 equals $2408 per month)

●Divide the monthly pay by 2 to determine the anticipated pay per pay period. ($2408 divided by 2 equals $1204 per pay period)

May

For the application month of May, the 05/05 and the 05/20 must be used because they occurred in the budget month.

June

For the interview month of June, the 06/05 paycheck must be used because it occurred in the budget month. The anticipated pay of $1204 at $14 per hour is used to anticipate the 06/20 paycheck.

July

For July and ongoing months, the 06/05 paycheck is removed. Only the anticipated 06/20 paycheck of $1204 is used for ongoing months.

DBME BEST Google Job Aids

last revised 04/29/2024