Procedure: Projecting a 30-day Income Period

|

This section provides procedures for budgeting a 30-day period.

Procedures

When the participant is present, have them sign the Authority to Release (FAA‑1765A) form to contact any companies or businesses involved. The FAA-1765A can be faxed or emailed to the participant's employer when it is not possible to use the Application for Benefits (FAA-0001A) or the HEAplus Authority to Release signed statement.

Project income based on a discussion with the participant and the verified income using the income that is reasonably certain to continue. (See Example 1 and Example 2)

A 30-day income period is used for all of the following budget months when the income is normal and expected to continue:

●The first month of a new application when the interview is conducted in the application month.

NOTE When the interview is conducted in the month after the application month, see Projecting a Full Month of Income to determine the budget for the application month.

●The first month of the approval period for a renewal application

●Ongoing months after a new application, renewal application, or after processing a change.

NOTE Semi-monthly paid income must have two consecutive pay periods verified. Determine a missing pay period using year-to-date totals when paystubs are available and there is a missing pay period between stubs.

AZTECS Keying Procedures

Budget all the income received in a 30-day period by keying all of the following information on EAIC or UNIC:

●The Income Type Code in the INC TYPE field and the SUB TYP field as needed.

●The Income Frequency Code in the FREQ field.

●Each date income was received in the DATE PAID field.

●The work hours in the HOURS field.

●The gross amount(g) for each pay date in the GROSS AMOUNT field.

●Ensure to copy details into the Current System Month(g) and leave the same income keyed for ongoing months when no changes are expected.

NOTE When the unearned income is received monthly, key the gross income on UNIN. Key the gross income on EAIC for earned income received monthly.

Examples

1) The participant applies and is interviewed 01/31. The participant provided the following weekly pay stubs:

|

Date Paid

|

Hours

|

Gross Amount

|

|

01/01

|

40

|

$400

|

|

01/08

|

40

|

$400

|

|

01/15

|

40

|

$400

|

|

01/22

|

40

|

$400

|

|

01/29

|

40

|

$400

|

Since the weekly income received from the prior 30 calendar days is all the same, key the following on EAIC for February and ongoing:

The keying of the income this way, does not change the monthly gross income budgeted.

Document why only one pay stub is keyed.

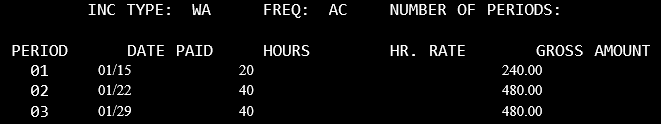

2) The participant applies and is interviewed on 01/29. The participant has started a new job and has received and provided the first two pay stubs:

|

Date Paid

|

Hours

|

Gross Amount

|

|

01/15

|

20

|

240

|

|

01/22

|

40

|

480

|

The worker completed a collateral contact to the employer during the interview. The following was documented:

●The employer stated that the participant is expected to work 40 hours at an hourly rate of $12.00 paid weekly on Friday.

●The employer stated that the pay stub for 01/15 is low because the participant started working in the middle of a pay period.

●The 01/22 pay stub for 40 hours at $480 gross is normal and is expected to continue.

●The worker practiced prudent person concept and asked about the pay stub for 01/29. The employer verified that the pay stub for 01/29 has been disbursed for the gross amount of $480, which is normal.

All checks received in the application month must be budgeted in the month of application. Key the following on EAIC for the initial month of January:

For February and ongoing months, drop the low check and leave the following keyed on EAIC:

last revised 10/02/2023