Flex Credits

|

This section includes information about income received as flex credits.

Policy

Flex credits are funds that are made available to the participant by the employer to purchase any of the following benefits:

●Life Insurance

●Health Insurance

●Annual or Sick Leave

Flex credits are not countable as earned income when the employee cannot choose to receive a cash payment in lieu of purchasing benefits.

Flex credits are countable as earned income when the employee can choose to receive a cash payment in lieu of purchasing benefits. The greater amount of any of the following are budgeted:

●The employer established cash value amount of the flex credit.

●The amount remaining after subtracting the cost of the benefits, when the total of the benefits purchased by the employee is less than the flex credit.

Countable income is used to determine an income budget. (See Income Budgeting to see how FAA determines the income budget.) FAA needs to know about income that is both countable and not countable to determine whether a budgetary unit’s expenses are exceeding their income. (See Income Eligibility for more information about how FAA uses countable and not countable income.)

Procedures

When the participant is present, have them sign the Authority to Release (FAA‑1765A) form to contact any companies or businesses involved. The FAA-1765A can be faxed or emailed to the participant's employer when it is not possible to use the Application for Benefits (FAA-0001A) or the HEAplus Authority to Release signed statement.

When the flex credits are listed within the gross income amount of another type of income, complete all of the following:

●Manually subtract the flex credit amount from the gross income amount.

●Discuss with the participant whether the flex credit is received with a set pay frequency. (e.g., weekly, quarterly, yearly, etc.)

●Clarify with the employer when the participant is unsure whether the flex credits are ongoing.

●Determine the flex credit budget. When appropriate, enter the budget in AZTECS through the current system month using the flex credit Income Type Code identified in AZTECS Keying Procedures.

Flex credits are budgeted and keyed separately from other types of income. (See Example 1)

See Income Budgeting for budgeting procedures.

Verification

System interface and the case file(g) must be reviewed before verification is requested. No additional verification is needed when AZTECS interface or HEAplus hubs have verified the information.

The participant has the primary responsibility for providing verification. (See Participant Responsibilities – Providing Verification for additional policy.)

For NA, all of the following income is required to be verified before eligibility is determined:

●Reported on a new application, during the interview of a new application, or changes reported before the eligibility determination of a new application.

●Changes after an eligibility determination of a new application (e.g., a renewal application, mid approval contact, etc.) and any of the following apply:

The source of the income has changed.

The income is questionable(g) or unclear(g).

The reported income amount has changed by $51 or more.

The previous verification in the case file is more than 59 calendar days old.

For CA, all income is required to be verified before determining eligibility.

Examples of verification that can be used for flex credits include, and are not limited to, any of the following:

●System interface(g) when the participant agrees that the information is accurate.

●A copy of a paycheck stub.

●Copy of checks when the gross earnings are listed.

●A printout from a third-party payroll verification source provided by the participant.

●Third-party payroll verification sources when the employer uses the verification source as its legal agent to provide payroll services or respond to inquiries about employee records. (See Third-Party Payroll Verification Sources(g) for FAA approved sources, additional information, and instructions for requesting additional sources.)

●A New Employment Verification (C005) notice that is completed, dated, and signed by the employer or their payroll authority. To be considered complete, the statement has to include all of the following:

Name, address, and telephone number of the employer

Gross pay for the periods needed

Frequency of pay (e.g., weekly, monthly, quarterly, etc.)

Day of the week or day of the month pay is received (e.g., Fridays, 5th and 20th of the month, first of the month, etc.)

Any expected change in pay

●For new or current employment verification, a completed Verification of New/Current Employment (FAA‑0053A) form that includes a date and the signature of the employer or their payroll authority.

●For terminated employment verification, any of the following completed items that include a date and the signature of the employer or their payroll authority:

Verification of Terminated Employment (FAA-1701A) form

Verification of Terminated Employment (C019) notice

●Letter from the agency providing government-sponsored training.

●Leave and Earnings Statement (LES) from the military.

●A collateral contact with the employer or their payroll authority.

NOTE Collateral contact is not used when contacting the employer would jeopardize the participant's employment or when the employer does not accept telephone verification.

●Participant statement verification when one of the following occur:

Obtaining documented or collateral contact verification may cause harm or undue hardship(g) for the participant.

When all of the following occur:

●Other attempts to obtain the verification have failed. This includes documented and collateral contact verification.

●The participant has requested assistance from FAA.

●The worker has evaluated the request for assistance and cannot obtain the verification from another acceptable source.

●The participant statement is not questionable(g).

NOTE Many companies do not allow verification over the telephone. When an FAA-0053A or FAA-1701A must be completed by any of the following, see the company’s contact information to determine where FAA staff must send the form:

AZTECS Keying Procedures

Key the budgeted amount on EAIC separately from other types of income using one of the following:

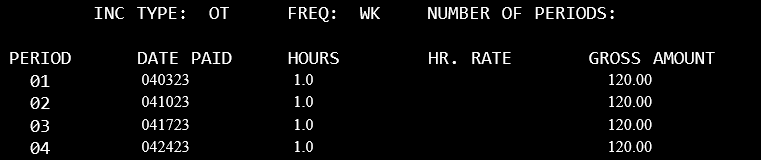

●When countable, the OT Earned Income Type Code.

●When not countable, the OX Earned Income Type Code.

For more information on how to budget flex credits, see Example 1.

Document the case file(g) thoroughly to support keyed codes, amounts, and frequencies. See the AZTECS Data Entry Guide for instructions on keying the AZTECS income screens.

NOTE Documentation must support determinations of eligibility and benefit level. Document in sufficient detail to ensure that any reviewer can assess whether the determination is reasonable and accurate. Include specific information regarding the reason the income is determined to be normal. (See Budgeting Income Documentation Requirements for additional information.)

Examples

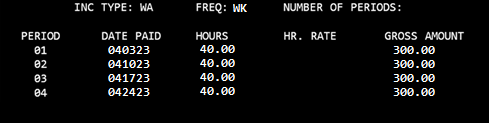

1) John applies and is interviewed on April 30. He states that he is paid weekly and provides the following paycheck stubs:

●Paid on 04/03, 40 hours, gross amount $420

●Paid on 04/10, 40 hours, gross amount $420

●Paid on 04/17, 40 hours, gross amount $420

●Paid on 04/24, 40 hours, gross amount $420

The deductions on the pay stub identify that John receives a flex credit in the amount of $120 on each of his paycheck stubs. John states during the interview he receives cash for a flex credit added to his gross pay.

All of the following is keyed on EAIC for John:

NOTE The flex credit is subtracted from the gross pay and budgeted as countable income on a separate income screen. When keying the hours for the flex credits, use one hour for the number of hours worked.

Legal Authorities

AAC R6-12-501 – 503

A.R.S 46-292-P01

7 CFR 273.9(b)

7 CFR 273.9(b)(2)

last revised 10/02/2023