Application Screening

|

Before completing an interview, FAA ensures the application and programs are registered correctly and screened for possible changes or potential eligibility in other programs.

Policy

FAA staff review each application to ensure the application is completed and for any other possible actions needed including, and not limited to, all of the following:

●Involvement with other agencies

●Potential changes to active programs

●Potential eligibility for all programs

●Potential eligibility for expedited service (See NA Expedited Applications Eligibility)

State Verification Exchange System (SVES) information is received by FAA as a result of computer matching between FAA and other agencies. The matching of computer system information is required by federal law. When information is verified through SVES(g), additional verification is not needed. Information that may be obtained from SVES includes, and is not limited to all of the following:

●Security and SSI benefit information from the Beneficiary and Earnings Data Exchange (BENDEX) or State Data Exchange (SDX).

●Unemployment Insurance benefits information available through the Household System Check (HOSC).

●Child Support Income issued through the Division of Child Support Services (DCSS) and displayed on CHSP.

●Wire Third Party Information (WTPI).

●Health-e-Arizona Plus (HEAplus) Social Security Online - State On-Line Query Internet (SOLQI) Response Data Summary.

Procedures

New Application Screening

FAA must also review new applications to ensure the application is registered correctly and other possible actions needed including, and not limited to all of the following:

●CA applicant’s potential eligibility for Grant Diversion (GD)

●CA applicant's potential eligibility for Kinship Child Only special considerations (See Kinship Child Only Screening)

●Potential eligibility for Elderly Simplified Application Project (ESAP) (See ESAP)

Inquire on all applicants, see all of the following:

Upload(g) to OnBase, hard copy screen prints of any interface information found.

Renewal Application Screening

Complete systems inquiries for all participants. At the time of the interview, screen the renewal application for potential changes. The screening process and any changes are addressed by the close of the following workday(g) whenever possible.

Review all of the following AZTECS screens:

●CAP1

●CAP2

●CAP3

●EAIN

●EXNS

●HOSC

●HOSU

●SEEI

●UNIN

●WTPI

Renewal applications received more than 60 calendar days before the end of the current approval period must be treated as a reported change.

Quick Access Menu:

State Verification Exchange System (SVES)

The sub-systems or screens used in SVES includes and is not limited to all of the following:

●HOUSEHOLD SYSTEM CHECK (HOSC)

●BENEFIT AGENT CLAIM INQUIRY

●WIRE THIRD PARTY INFORMATION (WTPI)

●BENDEX INFORMATION (BDXI)

●Beneficiary Exchange Earnings Record

●HEAplus SOLQI Response Data Summary

For information and instruction on AZTECS procedures, see AZTECS keying procedures, Household System Check (HOSC) AZTECS Procedures, and Interface Inquiry (ININ).

Employment Verification Information (EMVI)

When clarification of EMVI information is needed, follow the verification process. The verification process includes documented verification, interface verification, collateral contact verification, and participant statement verification.

Do not contact employers listed on EMVI unless the information provided by the most current EMVI record is questionable(g) or unclear(g). Examples of questionable or unclear EMVI information that may require contact with the employer may include any of the following:

●Bonus income displays but date or frequency of receipt information is missing

●The hourly rate displayed does not match the hourly rate reported by the participant

●The hours per pay period displayed do not match the hours reported by the participant

●The participant is reported as an active employee on EMVI, but the participant reports that this employment was terminated

NOTE Do not call for employment or wage information verification from any of the following employers:

●Wendy's: Employment verification for any of the specified Wendy's restaurants must be requested from their corporate office. See Wendy’s Employment and Wage Information.

●Solutions Staffing: Request employment verification via U.S. mail only. See Solutions Staffing for contact information.

See EMVI AZTECS Procedures for information on AZTECS procedures and keying instruction.

Household System Check (HOSC)

HOSC interfaces with other systems and provides information regarding income a participant may be receiving currently, or in the past.

HOSC interfaces include the Unemployment Insurance (UI) Administration GUIDE system to display base wage and UI benefit information and the Division of Child Support Services (DCSS) to display child support information.

HOSC will display all of following information for each participant registered to a case in AZTECS:

●Edit messages prompting workers to check any of the following systems or screens in AZTECS when information is available that may affect eligibility:

ININ - Review EMVI, WTPI, BDXI, and SDXI when prompted.

CHSP - Review CHSP regardless of whether an indicator displays in this field.

EMPLOYER INFO/BASE WAGE

●Identifying information for each employer during the last six quarters, from the date HOSC is accessed. (See HOSC – Employment Information)

●Unemployment claim information. (See HOSC – Unemployment Information)

When employment information is displayed on HOSC, the information must be verified. (See HOSC – Employment Verification Requirements)

Review HOSC and upload(g) the HOSC AZTECS screen into OnBase(g) prior to the interview or when any of the following apply:

●A change in budgetary unit composition is reported. (See Adding a Participant.)

●A participant reports any of the following:

They have applied for UI

They have started receiving UI benefits

A change has occurred regarding their UI benefits

Refer CA participants to file for UI benefits when any of the following apply:

●Income displays in any of the four calendar quarters prior to the date HOSC is accessed.

●The participant reports terminated employment.

NOTE Participants applying for NA only are not required to apply for UI benefits.

See Household System Check (HOSC) AZTECS Procedures for information and instruction on keying AZTECS.

Household SSN Substitution (HOSS) Purpose

Household SSN Substitution (HOSS) is used to replace the SSN or pseudo number displayed in AZTECS with the SSN under which the participant is working. AZTECS interfaces with UI to display base wage and UI benefit information for the alternate SSN.

Base wage and unemployment benefit information is confidential and must be used only to determine a participant's eligibility for FAA benefits.

For information on how to key HOSS, see HOSS SSN Substitution AZTECS Procedures.

HOSC Employment Information

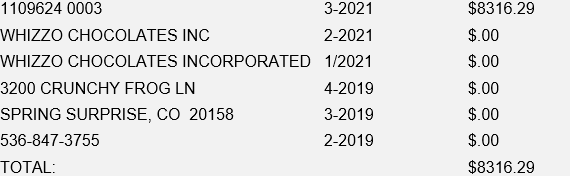

All of the following information displays on HOSC in the EMPLOYER INFO / BASE WAGE fields:

●Unemployment Insurance (UI) Employer Number. When zeros display in place of a UI Employer Number or there is inaccurate information, elevate to the Policy Support Team (PST) via email, see [email protected].

●Name

●Address

●City, state, and ZIP Code

●Telephone number

NOTE Review the employer identifying information with the participant when verifying income. A line break separates each employer's information. When no wage information is available for the participant for the last six quarters, the following edit message displays in the EMPLOYER INFO / BASE WAGE field: NO DATA AVAILABLE FOR LAST 6 QUARTERS

●Base wage information from each employer during the last six quarters, from the date HOSC is accessed. Information displays in the QUARTER and EARNINGS fields for each employer identified in the EMPLOYER INFO / BASE wage field as follows:

Wage information displays in the EARNINGS field when wages are reported in any of the last six quarters.

Up to six quarters of information displays, beginning with the most current of the last six quarters.

Quarters in which no wages are reported display $ .00 in the EARNINGS field.

When the remainder of the six quarters following a quarter with wage information are quarters in which no wages are reported, the quarters do not display. (See Example 1)

HOSC Employment Verification Requirements

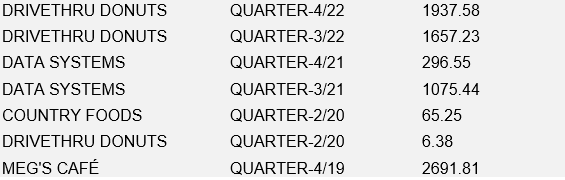

Information from each employer during the last six quarters displays. One asterisk (*) indicates the current quarter. The earnings will display as zero until the quarter ends and the employer reports the earnings. Two asterisks (**) indicates the last two quarters. All income in these quarters must be verified as current or terminated. (See Example 2)

Verify income displayed in the two calendar quarters prior to the date HOSC is accessed when verification is not in the case file(g).

When a participant is working under a Social Security Number (SSN) that does not belong to them, complete an inquiry for that SSN by using HOSS. For information on HOSS, see HOSS SSN Substitution AZTECS Procedures. For more information on HOSC Employment Verification, see EMVI AZTECS Procedures.

HOSC Unemployment Information

The unemployment information that displays on HOSC includes and is not limited to all of the following:

●Unemployment Insurance (UI) benefit payment information in the UNEMPLOYMENT INFORMATION field, as follows:

The last 180 days of UI benefit payments from the date HOSC is accessed.

The gross amount of UI benefit payments issued when there is no overpayment.

The adjusted gross amount issued when there is an overpayment.

Status of the UI benefit payment. (See Unemployment Insurance (UI) Pay Type Codes)

The disqualification code when there is a disqualification. (See UI Disqualification Codes)

Child support being paid from the UI.

The amount withheld to repay a UI overpayment.

NOTE When no UI information is available, the UNEMPLOYMENT CLAIM INFORMATION fields display NO DATA AVAILABLE.

●UI benefit claim information in the UNEMPLOYMENT CLAIM INFORMATION field, as follows:

The benefit year begin and end date

The weekly benefit amounts

The benefit amount paid to date

The benefit balance remaining

The UI overpayment balance

NOTE When no UI information is available, the UNEMPLOYMENT INFORMATION fields display NO DATA AVAILABLE.

When the participant has applied for UI, information displays in all of the following fields:

●BENEFIT YEAR BEGIN

●BENEFIT YEAR END

●PAID TO DATE

●BAL

●WKLY BEN AMOUNT

●OVERPAYMENT BAL

BG01 General Unemployment Insurance Developmental Effort (GUIDE)

The Unemployment Insurance (UI) Administration allows FAA to make inquiries into the General Unemployment Insurance Developmental Effort (GUIDE) system to review claims and benefit payment information.

GUIDE is used by any of the following FAA staff only:

●Overpayment Writers

●Appeals Specialists

NOTE GUIDE information is confidential and must be used only to determine a participant's eligibility.

For AZTECS keying instructions, see BG01 GUIDE AZTECS Procedures.

HEAplus SOLQI Response Data Summary

Health-e-Arizona Plus (HEAplus) interfaces with both federal and state data sources to verify required information. The HEAplus State Online Query Internet (SOLQI) Response Data Summary screen displays the data received from the Social Security Administration (SSA) for the Social Security Number (SSN) entered.

One of the following displays in the Verification section of the SOLQI screen to indicate whether the demographic data (Name, Date of Birth (DOB), and SSN) entered in HEAplus is verified:

●SSN is verified

●SSN is not verified

See the SOLQI Desk Reference Guide located in the FAA Policy Support SharePoint Site Doc Library. (Internal use only)

Verification

System interfaces and the case file(g) must be reviewed before verification is requested. No additional verification is needed when AZTECS interface or HEAplus hubs have verified any of the nonfinancial or financial eligibility factors. Information provided through the State Verification Exchange System (SVES) by the primary source of the information is considered verified upon receipt(g).

The participant has the primary responsibility for providing verification. (For additional policy see, Participant Responsibilities – Providing Verification.)

Examples

1) HOSC displays all of the following available for the participant:

●EMPLOYER INFO BASE WAGE AND QUARTERS

2) When HOSC is accessed in July (Third Quarter) verify all of the following:

●The First Quarter (January, February, March) of the same year.

●The Second Quarter (April, May, June) of the same year.

When HOSC is accessed in April (Second Quarter) verify all of the following:

●The Fourth Quarter (October, November, December) of the previous year.

●The First Quarter (January, February, March) of the same year.

3) W6 Wage Inquiry screen displays current and past employers and earnings for the participant.

AZTECS Keying Procedures

Quick Access Menu:

Household System Check (HOSC) AZTECS Procedures

HOSC is accessed by keying all of the following on INME:

●19 in the FUNCTION (BY NUMBER) field

●The case number in the CASE NUMBER field

Household SSN Substitution (HOSS) AZTECS Procedures

HOSS displays when Y is keyed in the SSN SUBSTITUTION field on HOSC.

HOSS displays all of the following for each participant registered to an AZTECS case:

●The participant's name

●The participant's Social Security Number (SSN) or pseudo number

●A field to key an alternate SSN

Complete all of the following to inquire on an SSN under which a participant is working:

●Key the additional SSN next to the participant who is using the SSN

●Press F6

When F6 is pressed, HOSS returns to HOSC. HOSC displays the base wage and Unemployment Insurance (UI) benefit information for any of the following:

●The participant who is using the additional SSN

●The remaining participants registered to the case

BG01 GUIDE AZTECS Procedures

To access and inquire in the General Unemployment Insurance Developmental Effort (GUIDE) system, see the instructions outlined in the Access Guide Desk Aid (55 KB pdf).

Using the SSN, the participant is working under, inquire on the participant using any of the following as appropriate:

●To display a different screen for the same SSN, key the transaction option number in the TRANSACTION OPTION field, and press ENTER.

●To display the same screen for a different SSN, key the other SSN in the SSN field, and press ENTER.

By agreement with UI, designated FAA staff are to view only the following transaction options:

●W5 Pseudo Monetary Determination

The 05 PSEUDO MONETARY DETERMINATION screen displays earned income information. The income information is divided into four calendar quarters.

The bottom of the screen displays one of the following messages:

●THIS IS THE LAST PAGE OF BASE PERIOD WAGE INFORMATION FOR THIS SSN

●PRESS F2 FOR MORE INFORMATION

●W6 Wage Inquiry

The 06 WAGE INQUIRY screen displays current and past employers and earnings for the participants. (See Example 3)

The bottom of the screen displays one of the following messages:

●THIS IS THE LAST PAGE OF INFORMATION FOR THIS SSN.

●PRESS THE F2 KEY FOR ADDITIONAL WAGE INFORMATION.

●THERE IS NO WAGE INFORMATION FOR THE SSN.

●01 Summary Information

The 01 SUMMARY INFORMATION screen displays UI information that may exist for a participant. The message in the 01 CLAIM STATUS field displays the status of the participant's UI claim. The ACTIVE ISSUES field indicates the status of the participant's UI payments.

●04 Employer Information

The 04 EMPLOYER INFORMATION screen displays all of the following participant information:

●Last employer

●Non-base period employers

●Base period employers attached to an UI claim

●07 Benefit Payment History

The 07 BENEFIT PAYMENT HISTORY screen displays information about each payment that has been issued.

The status of the UI payment is indicated by the code in the PAY TYPE field. Situations affecting the participant’s eligibility must be resolved with UI before a payment can be issued. When an adjustment or determination changes the status of the pay type for the week, the code is updated. This can cause pay types to vary during the week.

This screen also displays the date the payment is issued. The UI payment is available two workdays(g) following the date the payment is issued. Benefits are received by a participant on the second workday following the date benefits are issued.

Press the F2 key to view more 07 BENEFIT PAYMENT HISTORY screens when there are more than 12 payments.

Key X next to the last day in the benefit week in the BWE field and press F6 to display the 13 BENEFIT PAYMENT INFORMATION screen for the BWE selected.

●12 Claim Profile Information

The 12 CLAIM PROFILE INFORMATION screen provides more detailed information regarding the most recent UI claim.

The message in the 12 CLAIM STATUS field displays the status of the participant's UI claim.

●13 Benefit Payment Information

The 13 BENEFIT PAYMENT INFORMATION screen displays UI benefit payment information for each benefit week the participant has a claim filed. This screen also displays each benefit payment issued.

This screen can only be accessed from the 07 BENEFIT PAYMENT HISTORY screen. Key X next to the last day in the benefit week in the BWE field and press F6 to select the appropriate BENEFIT PAYMENT HISTORY screen.

Press the F2 key to view the next Base Wage Earnings (BWE). Press the F7 key to view the previous BWE.

●25 Claimant Characteristics

The 25 CLAIMANT CHARACTERISTICS screen provides detailed information about the participant. Staff are able to view child support information on this screen.

●57 Employer Search

The 57 EMPLOYER SEARCH screen allows staff to search for an employer by keying their name or address.

To select an employer for review, key X to the far left of the field displaying the employer's information.

To view more detailed information, press PF6. This accesses the 58 Employer Base Information screen.

The bottom of the screen displays one of the following messages:

●NO REC FOUND

●THIS IS THE FIRST PAGE, PRESS PF2 FOR NEXT PAGE

●NEXT PAGE PRESS PF2, PREVIOUS PAGE PRESS PF7

●THIS IS THE ONLY PAGE

●58 Employer Base Information Inquiry

The 58 EMPLOYER BASE INFORMATION (EBI) INQUIRY screen displays the most current address and phone number information on an employer. This information does not display unless their account is in active status with UI.

Interface Inquiry (ININ) AZTECS Procedures

ININ is used to view and request information for the participant whose Social Security Number (SSN) displays in the SSN field. See all of the following:

To request or view information, key the number of the selection in the ENTER SELECTION (BY NUMBER) field on INME, and press ENTER.

To access ININ, key 9 in the FUNCTION (BY NUMBER) field on INME, and press ENTER.

Newest information on ININ is displayed first. Press ENTER to advance to older information.

BDXI AZTECS Procedures

The BENDEX INFORMATION screen is used to view Social Security Administration (SSA) information received from the SSA BENDEX file.

The response AZTECS receives from the SSA when requesting BENDEX information displays in the COMMUNICATION CODE field.

When a participant has dual or triple entitlement, the secondary SSN displays on this screen in the DUAL ENTITLEMENT INDICATOR or CROSS REFERENCE CAN fields.

BDXI is accessed by keying 1 in the ENTER SELECTION (BY NUMBER) field on ININ.

SDXI AZTECS Procedures

SDXI is used to view Supplemental Security Income (SSI) benefit information from the Social Security Administration's State Data Exchange file.

SDXI is accessed by keying 2 in the ENTER SELECTION (BY NUMBER) field on ININ.

When a phrase other than DEEMING OVERRIDE displays in the DEEMING INDICATOR field, check for other sources of income.

EMVI AZTECS Procedures

The EMPLOYMENT VERIFICATION INFORMATION (EMVI) screen is an AZTECS interface screen. Use EMVI to view employment and income information from employers participating in Equifax verification services.

AZTECS auto generates an EMVI record for all participants, age 16 or older, who have a valid SSN and when one or more of the following occurs:

●Registration of a new application on REAP

●Registration of a renewal application on RERE

●A program is added to an active case on APMA

●Information is changed on SSDO

●Information is changed on CLMA

A new EMVI record may be manually generated when any of the following apply to the previous EMVI record:

●The information is insufficient to determine the income that is reasonably certain to be received during the approval period

●The information is more than 59 days old

Manually generate a new EMVI record on CLPR by completing the TO REQUEST EMPLOYMENT VERIFICATION, ENTER Y field.

EMVI records are accessed by keying 5 in the ENTER SELECTION (BY NUMBER) field on ININ.

Each EMVI record consists of two screens. The first screen displays the participant’s personal and employment information. The second screen displays 60 days of income information from the date of the request. EMVI displays the newest information first. Press ENTER to advance to older information.

NOTE When the date of a new request is within 60 days of the date of a previous request, the new EMVI record displays only the information received after the date of the previous request.

WTPI AZTECS Procedures

Use WIRE THIRD PARTY QUERY INFORMATION (WTPI) to view information from the Social Security Administration (SSA) via the Wire-to-Wire Third Party Query (WTPY) system.

To access WTPI, key 3 in the ENTER SELECTION (BY NUMBER) field on ININ, and press ENTER.

An interface occurs nightly with AZTECS and SSA. WTPY requests are generated by AZTECS when any of the following occur:

●A new application is registered on REAP

●A renewal application is registered on RERE

●A program is added to an active case on APMA

●A new participant is added to an active case

●Participant information is inquired on CLIENT INQUIRY/MAINTENANCE (CLIM) and changed on CLIENT INQUIRY/MAINTENANCE CLMA

●Information is changed on SSDO

Manually generate a new WTPY record on CLPR by completing the TO REQUEST WTPY, ENTER Y field.

When WTPI displays the message SSN IS VERIFIED, SSA has verified that the name matches the NUMIDENT information(g).

SSA and SSI benefit information displays when it exists for a participant. When the Wire Third Party response indicates that no SSA or SSI benefit records exist, the following message displays:

ONLY THE MOST RECENT WTPY RECORD IS MAINTAINED.

Legal Authorities

7 CFR 273.2(a)(2)

7 CFR 273.2(b)(2)

7 CFR 273.2(b)(3)

7 CFR 273.2(b)(4)

7 CFR 273.2(d)

7 CFR 273.2(f)(4)

7 CFR 273.2(f)(5)

7 CFR 273.2(f)(5)(ii)

7 CFR 273.2(f)(6)

7 CFR 273.2(f)(7)

7 CFR 273.2(f)(8)(i)

7 CFR 273.2(f)(9)

7 CFR 273.2(f)(10)(iii)

7 CFR 273.2(f)(1)(ii)

last revised 02/26/2024