Procedure: Projecting with High or Low Paychecks

|

This section provides information about procedures for determining a budget when there is a high or low paycheck.

Procedures

When the participant is present, have them sign the Authority to Release (FAA‑1765A) form to contact any companies or businesses involved. The FAA-1765A can be faxed or emailed to the participant's employer when it is not possible to use the Application for Benefits (FAA-0001A) or the HEAplus Authority to Release signed statement.

See Anticipating Income and do not use projecting income budgeting when any of the following occur:

●One or more semi-monthly checks do not represent the participant’s ongoing income.

●No recent paychecks in the 30-day income period are normal and expected to continue.

NOTE Income received during the budget month must be used in the budget of that month.

Budget unusually high or low checks(g) in the month the unusual income is received. For the following ongoing months, only budget the paychecks representing the income reasonably certain to continue. Remove from the budget any checks that are not expected to continue. When the high or low checks are not in the budget month, drop them from the budget. (See Example 1)

NOTE When a high or low check is a normal part of what is reasonably certain to continue, the high or low checks are included in the budget to project income for ongoing months.

AZTECS Keying Procedures

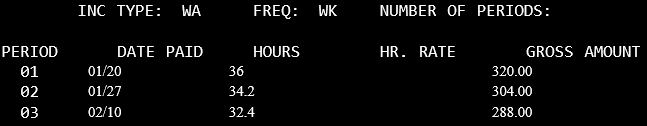

To project income when a high or low paycheck is received, include the unusually high or low paycheck only for the budget month the unusual income is received, and key all of the following on EAIC or UNIC:

●The Income Type Code in the INC TYPE and the SUB TYP field as needed.

●The Income Frequency Code in the FREQ field.

●Each date income was received in the DATE PAID field.

●The work hours in the HOURS field.

●The gross income for each pay date in the GROSS AMOUNT field.

●Ensure to copy details into the next month or the Current System Month and remove the unusual income from the budget. Use the remaining paychecks to project ongoing income when the remaining paychecks are reasonably certain to continue.

NOTE When the high or low paycheck is reasonably certain to continue, include the paycheck for ongoing months.

DBME BEST Google Job Aids

Example

1) Unusually High or Low

Do not budget unusually high or low checks that are not in the budget month.

Jennifer applies and is interviewed on 02/15 for a March renewal. She is paid weekly on Fridays and verifies her income. Jennifer states her income received on 02/03 is lower than normal due to an unpaid holiday.

|

Date Paid

|

Hours

|

Gross Amount

|

|

01/20

|

36

|

$320

|

|

01/27

|

34.2

|

$304

|

|

02/03

|

22.5

|

$200

|

|

02/10

|

32.4

|

$288

|

For MARCH, key the following on EAIC:

The 02/03 check is not keyed as it is verified to be unusually low and is not received in the budget month.

last revised 10/02/2023