Procedure: Budgeting Day Labor

|

This section provides information about procedures for budgeting day labor.

Procedures

When a participant receives income daily, budget as actual income.

For new and renewal applications, use the income received in a 30-day income period without converting the income to a monthly amount. (See Example 1)

When a participant is paid at the end of each workday, the work is considered day wages or daily labor. Budget the actual amount received by a participant during a 30-day income period. Complete all of the following:

●Verify pay dates, hours, and gross pay for each day the participant worked during a 30-day income period.

●Add the gross pay from each date paid and use the total as the monthly income amount.

●Add the work hours and divide the work hours by the number of days worked to determine the average monthly work hours.

NOTE When a participant is paid on regular basic convert the income to a monthly amount.

When a participant has received more than eight paychecks during the income budgeting period, manually total the gross income and hours before entering the income into AZTECS.

Documentation must support determinations of eligibility and benefit level. Documenting in sufficient detail includes all of the following:

●Ensure that any reviewer can assess whether the determination is reasonable and accurate.

●Include specific information regarding the reason for how the income is budgeted.

(See Income Documentation Requirements for more information about documentation.)

When the participant is present, have them sign the Authority to Release (FAA‑1765A) form to contact any companies or businesses involved. The FAA-1765A can be faxed or emailed to the participant's employer when it is not possible to use the Application for Benefits (FAA-0001A) or the HEAplus Authority to Release signed statement.

AZTECS Keying Procedures

For actual income, complete all of the following:

●Day labor or daily wages, key all of the following on EAIC:

WA in the INC TYPE field

AC in the FREQ field

Pay date in the DATE PAID field

Number of hours worked in the HOURS field

Gross amount paid in the GROSS AMOUNT field

NOTE EAIC only has eight lines for pay dates and income. When a participant has received more than eight paychecks during the income budgeting period, manually total the gross income and hours.

Examples

1) Clark applies for NA for himself and completes the interview on 03/17. The only income Clark receives is from day labor. Clark expects his income to continue without changes. Clark provides all of his paycheck subs from a prior 30-day period, 03/17 back to 02/16:

●Pay Date 02/16 Hours 4.80 Gross Pay $20.00

●Pay Date 02/18 Hours 2.50 Gross Pay $10.00

●Pay Date 02/23 Hours 3.20 Gross Pay $15.00

●Pay Date 02/25 Hours 2.5 Gross Pay $10.00

●Pay Date 02/27 Hours 3.90 Gross Pay $17.00

●Pay Date 03/01 Hours 4.10 Gross Pay $20.00

●Pay Date 03/07 Hours 5.60 Gross Pay $25.00

●Pay Date 03/10 Hours 2.50 Gross Pay $10.00

●Pay Date 03/13 Hours 3.50 Gross Pay $15.00

Clark worked a total of 32.6 hours in the 30-day income period.

The sum of Clark’s pay is $142.00 in the 30-day income period.

Clark received more than eight paychecks during the prior 30-day period, and EAIC only has eight lines for pay dates and income.

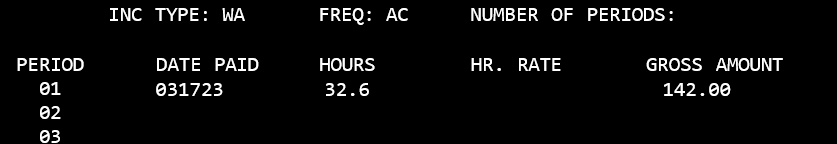

Enter the total of Clark’s hours and the sum of his pay on EAIC. For March and ongoing months, key all of the following on EAIC:

●The WA Income Type Code in the INC TYPE field

●The AC Income Frequency Code in the FREQ field

●The interview date in the DATE PAID field

●The total hours in the HOURS field

●The total income in the GROSS AMOUNT field

Case file documentation should be similar to the following.

“Wages are received daily. Received nine days of wages during the income period, keyed total gross income and hours.”

last revised 10/02/2023